Looking Into Your Conn's Payment Grace Period: What You Need To Know Today

For many who have financed items through Conn's HomePlus, questions about payment flexibility can certainly come up. Staying on top of your accounts, especially when life throws a curveball, is a pretty big deal. People often wonder about things like a `conns payment grace period` when they might need a little extra time to make a payment. It's a common thought, too, when you're managing household finances and dealing with different bills.

You might be thinking about how your payments work, particularly with all the recent news about Conn's. The company has made some changes to its payment systems, which is something many account holders will want to know about. Keeping up with these updates helps you manage your finances with them, and that's something we all appreciate.

This article aims to shed some light on managing your Conn's HomePlus financing. We will look at the payment process, recent company developments, and what it could mean for you. Our goal is to give you clear, helpful information about handling your Conn's account, addressing common concerns you might have about payment timing and options, so you can feel more prepared.

Table of Contents

- Understanding Payment Flexibility: The Idea of a Grace Period

- Conn's New Payment Process and Account Management

- Recent Changes at Conn's: What Happened with Stores and Operations

- Managing Your Conn's Financing Account

- What the Bankruptcy Filing Means for Customers

- Customer Service and Support for Your Payments

- Frequently Asked Questions

- Keeping Your Account Current: Tips for Payments

Understanding Payment Flexibility: The Idea of a Grace Period

When people talk about a `conns payment grace period`, they are usually wondering if there is a short window after their due date where they can pay without facing penalties. This concept, a grace period, is a common feature in many types of loans and credit agreements. It gives a borrower a little extra time, often a few days or weeks, past the official payment due date before late fees kick in or negative marks appear on their credit report. It's a way, you know, to offer a bit of breathing room for folks.

For someone with a Conn's HomePlus financing account, knowing if such a period exists could really help manage their budget. Life can be unpredictable, and sometimes a payment might be delayed by a day or two. A grace period, if offered, can prevent small delays from turning into bigger problems. It's about giving customers a fair chance to meet their obligations, which is something many companies consider.

It is worth noting that the specific terms of a grace period, including its length and what it covers, vary a lot from one lender to another. Some companies might have a seven-day grace period, while others could offer ten or even fifteen days. These details are usually spelled out in the original financing agreement you signed. So, it's pretty important to check those papers if you ever wonder about these things.

The idea of a grace period is often tied to customer service and helping people maintain good standing. It acknowledges that sometimes, things just happen. Knowing your options for payment flexibility is a key part of responsible money management, too. It allows you to plan better and avoid unexpected charges, which is something everyone wants to do, I'd say.

As of June 11, 2024, direct information about a specific, company-wide `conns payment grace period` in the context of their recent changes is not widely publicized in the provided text. This means customers should always refer to their individual financing agreements or contact Conn's directly to understand their specific payment terms and any available flexibility. It's always best to get the information straight from the source, that's for sure.

Conn's New Payment Process and Account Management

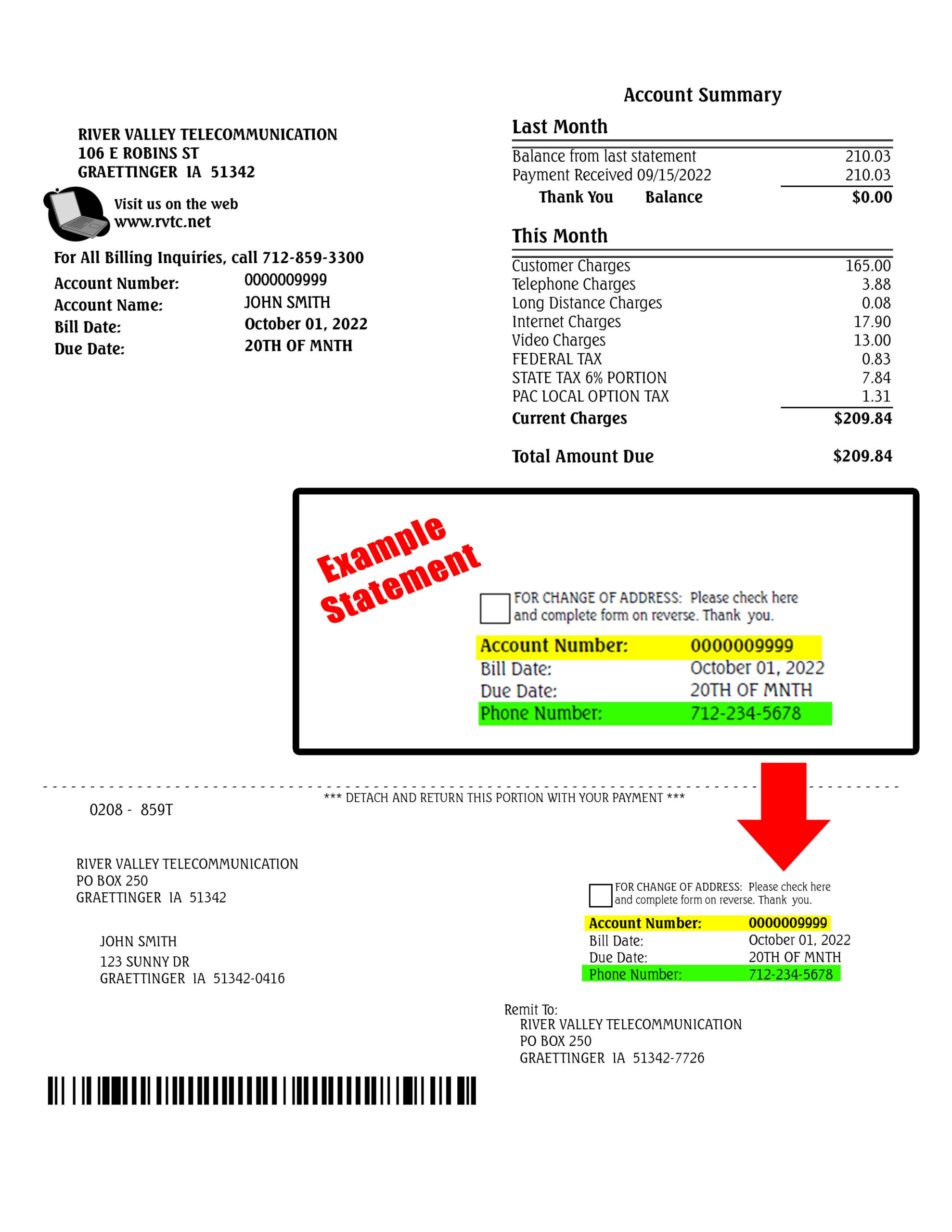

Conn's HomePlus financing has updated its payment process, and they say it's to make things better for you. They've also given their payment system a fresh look. This kind of change is often done to make paying your bill simpler and more convenient. You can now pay directly on their secure site, which is a pretty big step for many customers who prefer online transactions.

Getting started with this new payment portal is usually straightforward. It means you can manage your account from the comfort of your home, at any time that works for you. This convenience can be really helpful, especially if you have a busy schedule. Being able to access your account online, checking balances, and making payments is a modern convenience many people rely on, you know.

The ability to pay directly on a secure site addresses a common need for digital payment options. This move shows a commitment to making the payment experience smoother for customers. It reduces the need for mailing checks or calling in payments, which can save time and effort. Many folks find this way of paying much easier, and that's a good thing.

When you use the new payment portal, you can search for your Conn's HomePlus financing account without needing to log in first. This feature allows you to quickly check your balance, look at your payment history, or make a payment. It's a useful option for quick checks or if you just need to make a one-time payment without going through a full login process. This kind of access makes things a bit more accessible, really.

This updated process is part of Conn's effort to provide good customer service, offering fast and efficient ways to handle your financing. Even with other company changes happening, keeping the payment system functional and easy to use remains a priority. It's a key part of how customers interact with their financing agreements, and that's pretty important, I'd say.

Recent Changes at Conn's: What Happened with Stores and Operations

Conn's initially announced plans to close at least 70 of its locations after filing for bankruptcy. This news, which came out last week, was a significant development for the company. Later, it was announced that all stores would be closing. This kind of widespread closure can raise many questions for customers, especially about ongoing financing agreements and how they are affected. It's a lot to take in, you know.

The company, which was headquartered in The Woodlands, Texas, used to operate stores across many states. These included Alabama, Arizona, Colorado, Georgia, Louisiana, Mississippi, Nevada, Florida, New Mexico, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, and Virginia. The widespread nature of their operations means many people across different regions have financing accounts with them. It's a pretty broad reach, that.

The closure of all stores marks a major shift for Conn's. What was once an American furniture, mattress, electronics, and appliance store chain is now primarily focused on managing its existing assets and customer accounts. This change impacts how customers might have previously interacted with the company, such as visiting a store for inquiries or payments. So, that's a big difference for a lot of people.

Conn's HomePlus, the retailer of home goods, furniture, appliances, and consumer electronics, filed for Chapter 11 bankruptcy on July 23. This legal step often involves a company reorganizing its finances to pay off debts. For customers, it means that while the physical stores might be gone, the financing agreements still stand, and payments are still expected. That's a key point to remember, actually.

Even with these major operational changes, the company has expressed a commitment to customer service. This commitment is particularly important for those who still have active financing accounts. Finding ways to reach them and manage your payments becomes even more critical when physical locations are no longer an option. It's a slightly different way of doing things now, you see.

You can find listings related to Conn's, like their clearance center in Houston, TX, or information about former locations, on various sites. For example, you can see reviews, photos, directions, and phone numbers for Conn's locations in Red Oak, TX, on yp.com. While these listings might show past store information, they often reflect the company's previous presence and impact in local communities. It's a bit of a historical record, in a way.

Managing Your Conn's Financing Account

Keeping track of your Conn's HomePlus financing account is quite simple with their updated systems. You can search for your account to check its balance, look at your payment history, or make a payment without needing to log in. This feature makes it really easy to get quick updates on your account status. It's designed for convenience, you know, which is always helpful.

For those who prefer a more complete view, you can also search for your existing or new financing account. This allows you to check your account balance, review your full payment history, or make a payment. Having all this information readily available online helps you stay informed about your financial obligations. It's a straightforward way to keep tabs on things, that.

If you have an electronics credit card through Conn's, you can also apply for or manage it through their portal. This includes making payments, viewing your account balance, and seeing any special offers that might be available. It's a centralized place for all your Conn's related financing, which streamlines the process for many customers. That's a pretty good setup, I think.

The ability to access payment history is particularly useful for budgeting and record-keeping. You can see when payments were made, how much was paid, and what your remaining balance is. This transparency helps you plan future payments and ensures you are aware of your account status at all times. It gives you a clear picture, which is what you want, right?

Making a payment is a core function of the new portal. Whether it's a regular monthly payment or catching up on a missed one, the online system provides a direct way to send funds. This direct payment method is often the quickest way to ensure your account stays current. It takes away some of the fuss, you see.

Even with no recent activities showing for Conn's HomePlus in some places, the online portal remains the primary way to interact with your financing. It's important to remember that financing agreements are separate from the retail store operations. So, even if stores are closed, your payment responsibilities continue. That's just how it works, more or less.

What the Bankruptcy Filing Means for Customers

Conn's HomePlus filed its second amended liquidation plan in Texas bankruptcy court. This plan proposes how the remaining assets will be distributed to creditors after the sale of its operations to Jefferson Capital and other entities. For customers with financing, this part of the process mainly affects the company's creditors, not necessarily your immediate payment obligations. It's a legal step for the company, you know.

Under this plan, secured lenders might recover up to 73% of their claims, while unsecured creditors expect to get just 1%. Voting on this plan was scheduled to conclude by July 15, 2025. This detail shows the legal and financial restructuring happening behind the scenes. It's a complex process that aims to sort out the company's debts. That's pretty standard for a bankruptcy case, actually.

For customers who have outstanding financing, the bankruptcy filing generally means that your obligation to pay remains. The financing agreements are often held by a separate financial entity or are part of the assets being managed through the bankruptcy process. So, your contract to pay for the items you bought is still valid. That's a key point for everyone with an account.

It is important for customers to continue making their scheduled payments. Not doing so could lead to negative impacts on your credit score or collection efforts, just as with any other loan. The bankruptcy of the company itself does not automatically cancel your personal debt. It's a common misunderstanding, but your agreement is still in place, so.

If you have questions about your specific account due to the bankruptcy, contacting Conn's directly through their established customer service channels or the new payment portal is the best approach. They can provide clarity on your individual account status and payment expectations. It's always a good idea to seek direct answers, especially during times of company change, you know.

The sale of operations to companies like Jefferson Capital means that the servicing of your loan might eventually transfer to a new entity. If this happens, you would typically be notified by mail or email about the change and where to send future payments. Staying informed about these potential transfers is a good idea for managing your account without issues. It helps avoid any confusion, that.

Customer Service and Support for Your Payments

Conn's has stated a commitment to exceptional customer service, even amidst its operational changes. This commitment is especially important for customers who need help with their financing accounts. When you have questions about your `conns payment grace period`, your balance, or anything else, knowing how to reach someone is vital. They are trying to be there for you, so to speak.

The new payment portal is a primary tool for self-service, allowing you to check balances, view history, and make payments. However, for more specific inquiries or if you need to discuss payment options, direct contact with customer service is usually the next step. They can often provide personalized assistance that the online portal might not cover. That's where human interaction really helps, you know.

When reaching out, it's a good idea to have your account information ready. This includes your account number and any relevant details about your recent payments or inquiries. Being prepared helps the customer service representative assist you more quickly and efficiently. It just makes the process smoother for everyone involved, you see.

Given the company's situation, response times might vary, but persistence is key if you have an urgent matter. Using all available channels, like phone numbers listed on their official site or through the payment portal, can help you get the answers you need. It's about being proactive in managing your account, which is always a good strategy, I'd say.

For general inquiries or to find contact information, looking up official Conn's HomePlus financing resources online is a good start. These resources should provide the most current ways to get in touch with their support team. Keeping up with official announcements is pretty important, too, for any updates on how to reach them. That's a solid plan, actually.

The goal of customer service is to help you keep your account in good standing. If you are experiencing difficulties making payments, it is always better to communicate with them sooner rather than later. They might be able to discuss possible arrangements or options, even if a formal `conns payment grace period` isn't explicitly stated. Communication can often open doors, that.

Frequently Asked Questions

Here are some common questions people ask about Conn's financing:

How do I check my Conn's account balance?

You can check your Conn's HomePlus financing account balance by visiting their new payment portal online. You can search for your account there to see your current balance, payment history, and make a payment, even without logging in fully. It's a pretty quick way to get the information you need, you know.

Can I still make payments to Conn's?

Yes, you can still make payments to Conn's. The company has updated its payment process, allowing you to pay directly on their secure site through the new payment portal. Your financing agreements remain active despite store closures and bankruptcy filings. So, payments are still expected, that.

What happened to Conn's stores?

Conn's initially announced the closure of at least 70 locations after filing for bankruptcy, and later, it was announced that all stores are closing. The company, which was a furniture, mattress, electronics, and appliance chain, is no longer operating physical retail locations. It's a big change for them, you see.

Keeping Your Account Current: Tips for Payments

Staying on top of your Conn's HomePlus financing payments is always a good idea. Using the new payment portal is one of the easiest ways to manage your account. You can set up reminders or even automated payments if that option is available, which can help prevent missed due dates. It takes some of the worry out of it, you know.

Regularly checking your account balance and payment history helps you stay informed. This practice allows you to spot any discrepancies or confirm that your payments have been applied correctly. It's like a financial check-up, and it's pretty important for keeping things in order. That's just smart money management, I'd say.

If you anticipate any difficulty making a payment on time, reaching out to Conn's customer service before the due date is usually the best approach. While specific details on a `conns payment grace period` may vary, discussing your situation openly can sometimes lead to finding a solution or understanding your options. Communication can make a real difference, you see.

Remember that your financing agreement is a legal contract. Even with the company's recent changes, your obligation to pay for the items you financed continues. Keeping your account in good standing helps protect your credit score and avoids potential late fees or collection actions. It's about personal responsibility, more or less.

For more general information on managing personal finances and credit, you might find helpful resources from organizations like the Consumer Financial Protection Bureau. They offer guidance on various financial topics, which can be pretty useful. Learning more about credit scores and their impact on our site, and checking out tips for managing installment loans can also give you a broader perspective on handling your money well. These resources can give you a better overall picture, actually.

Conns Bill Payment

Conns Bill Pay Online - Grace Delilah

Easy Payment Solutions for Conns Furniture Shopping