Is Lendly Legit? What You Need To Know About This Online Option

Are you thinking about getting some financial help and wondering, "Is Lendly legit?" That's a really good question, you know. It's smart to check things out before you make any big decisions, especially with your money. Many people look for quick ways to get cash when unexpected costs pop up, and online services often come up as an option.

When you're looking into something like Lendly, you're probably trying to figure out if it's a real deal or if there's something to worry about. It's almost like you're asking, "Can I trust them with my needs?" This kind of careful checking helps you feel more secure about your choices, which is pretty important.

So, we're here to talk about what Lendly is all about, based on information available, and help you get a clearer picture. We will also, you know, clear up some confusion that might be out there. It's all about giving you the details so you can decide what's best for you.

Table of Contents

- What is Lendly, Really?

- How Lendly.com Works for You

- What About Your Credit History?

- Who Can Use Lendly.com?

- Making Your Decision

- Frequently Asked Questions About Lendly

What is Lendly, Really?

It's interesting, you know, how sometimes names can sound so similar but refer to totally different things. That's a bit what happens when people ask about "Lendli legit." There are actually two distinct entities that might pop up when you're doing your research, and it's pretty important to tell them apart. One is a financial service, and the other is a platform for renting items. We need to be very clear about this, you know, to avoid any mix-ups.

Lendly.com: The Financial Service

When most people are asking "Is Lendly legit" in the context of getting money, they are, in fact, thinking about Lendly.com. This is the online lender we're talking about, the one that offers actual financial products. It's where you might go if you need a loan or a line of credit. They are, you know, set up to help people get access to funds fairly quickly. So, if you're looking for a cash advance or an installment loan, this is the Lendly you're probably considering.

They are in the business of providing money to people, which means they deal with things like applications, credit checks, and transferring funds. It's a pretty straightforward financial operation, you know, like many other online lenders out there. Their whole purpose is to make it easier for people to get money when they need it, sometimes very fast, actually. This is the core of what people mean when they search for "lendli legit" in a financial sense.

Lendli.org: The Rental Platform

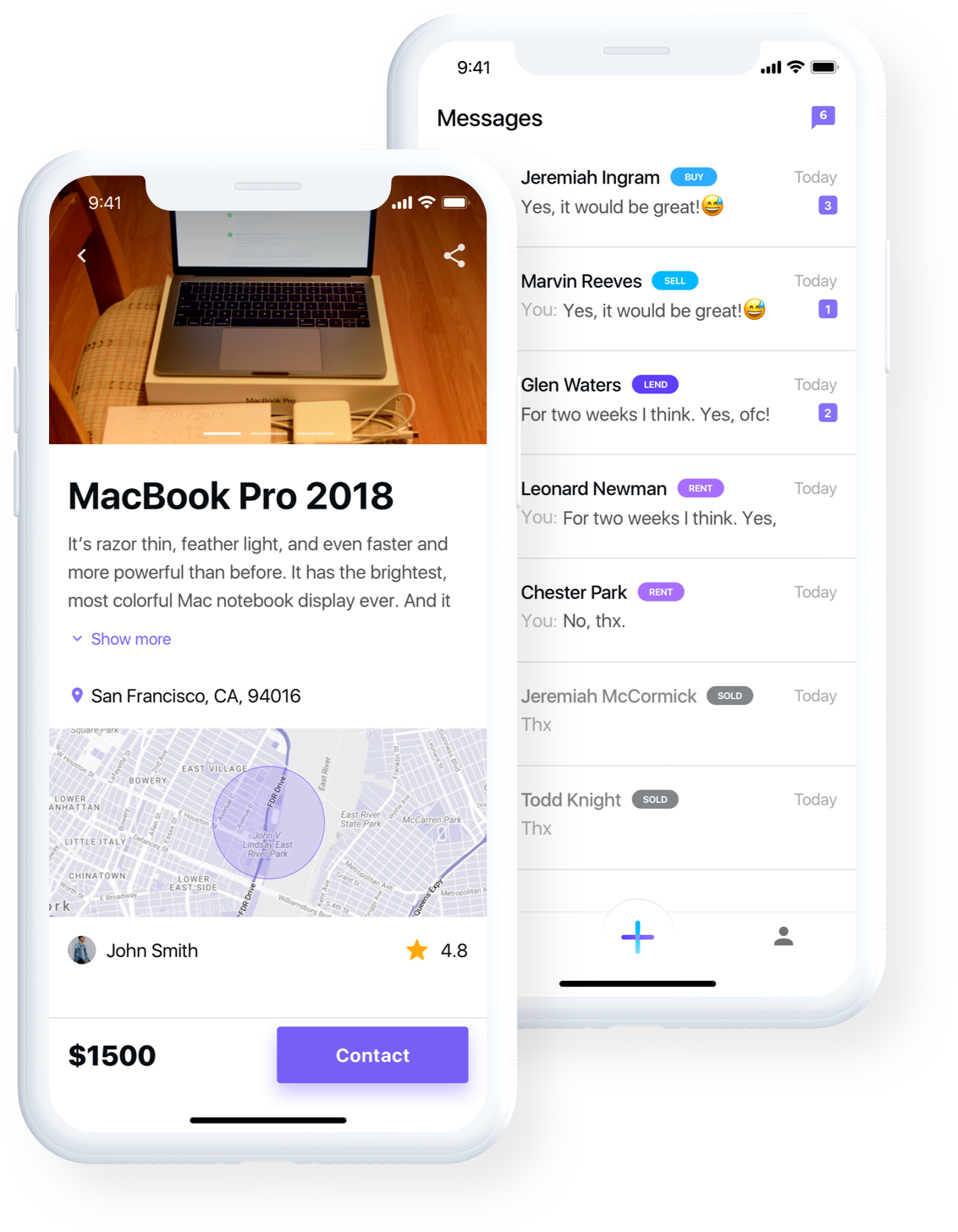

Now, this is where it gets a little different, you know. There's also a platform called Lendli.org, and it has a completely different purpose. This site is all about renting items, not about lending money. It started, as a matter of fact, in a small college dorm, which is a pretty cool origin story. The founder, Mikhaile, saw a need for sharing things like textbooks, and that's how this platform came to be.

Lendli.org lets you find and rent items effortlessly, which is pretty handy. Their platform aims to make renting safe and easy for anyone. It's a place where every item, you know, has a story, and every transaction is seamless. It's important to understand that Lendli.org is not a financial service at all. They do not engage in loan solicitation, lending, credit processing, or any financial transactions related to loans. Any mention of "lending" on their platform strictly refers to lending out items, not money. So, if you're looking to borrow cash, this isn't the place, you know.

How Lendly.com Works for You

Let's focus back on Lendly.com, the financial service, because that's what most people are curious about when they ask "Is Lendly legit?" This online lender has a few features that are pretty appealing, especially if you need money somewhat quickly. They aim to make the process easy and keep you in control, which is a big plus for many people, you know.

Getting Your Cash Quickly

One of the things Lendly.com highlights is quick funding. They say you can get cash in as little as 24 hours, which is pretty fast, actually. If you're facing an unexpected bill or an emergency, getting money that quickly can be a real help. It means you don't have to wait around for days, which can be a big relief when you're in a tight spot. This speed is often a key reason why people look into online lenders like Lendly.com, you know.

The process usually involves applying online, and if approved, the money is sent to your bank account. It's a streamlined approach that many people appreciate, especially in today's world where everything moves so fast. The idea is to make getting funds as hassle-free as possible, so you can deal with whatever situation you're facing without extra stress, you know.

Loan Amounts and Flexibility

Lendly.com offers a few different options when it comes to the amount of money you can get. They provide a line of credit that ranges from $300 to $1,500. A line of credit is pretty flexible, you know. It means you can access the cash you need, when you need it, up to your approved limit. So, if you only need a little bit of money now, but might need more later, this type of arrangement can be very useful.

They also offer online installment loans, which can be for $1,000, $1,500, or even $2,000. These are typically paid back over a set period with regular payments. Having these different amounts and types of credit means you have some choices, which is good. It allows you to pick what might fit your situation best, rather than being stuck with just one option. This flexibility is, you know, a key part of their offering.

No Hidden Fees: A Clear Approach

Nobody likes surprises when it comes to money, especially extra charges you didn't expect. Lendly.com states that they have no hidden fees or hassle, which is a pretty reassuring claim. This means that what you see is what you get, in terms of costs associated with your loan or line of credit. Transparency is, you know, something many people look for in financial services. It helps build trust and makes the whole process less stressful for you.

Knowing that there won't be unexpected charges popping up later can give you peace of mind. It allows you to plan your budget more accurately and feel confident about the terms of your agreement. This commitment to clarity is, you know, a positive sign for people considering their services.

What About Your Credit History?

A common question people have when applying for any kind of loan is, "How will this affect my credit?" It's a very valid concern, you know, because your credit history is important for many things. With Lendly.com, they do conduct a credit inquiry when you apply for a loan. This is pretty standard practice for lenders, actually.

Upon applying, a credit inquiry will likely appear in your credit history. This may have a small impact on your overall credit score. It's typically a minor dip, and it's something that happens whenever you apply for new credit, whether it's a loan, a credit card, or even some rental applications. So, it's not something unique to Lendly, but it's good to be aware of it. They also mention that stellar credit isn't required to get a loan from them, which is helpful for people who might not have a perfect credit score, you know.

This means that even if your credit isn't top-notch, you might still be able to get approved. They seem to look at more than just your credit score, which can be a relief for many folks. Just remember that any credit application can cause a slight, temporary change to your credit score. It's a normal part of the process, really.

Who Can Use Lendly.com?

Lendly.com is set up to help a specific group of people, you know. They are an online lender that offers small loans, up to $2,000, to individuals who meet certain criteria. One of the main requirements they look for is job history. You need to have at least six months of job history to be considered. This shows them that you have a steady income, which is a key factor in being able to pay back a loan.

As mentioned before, stellar credit isn't a must-have, which is pretty good news for many people. This means that if you've had some bumps in your credit past, you might still qualify. However, you'll have to let them, you know, look into your employment details to confirm your job history. It's all part of their process to make sure they are lending responsibly. They want to make sure you have the ability to repay the funds, which is fair for both sides, really.

So, if you've been working steadily for at least six months and need some quick cash, Lendly.com could be an option worth looking into. It's pretty straightforward in terms of who they aim to help, actually.

Making Your Decision

Deciding whether to use an online lender like Lendly.com is a personal choice, you know. It's about weighing your immediate needs against the terms of the loan. Knowing that Lendly.com is a legitimate online lender offering financial services, and not the rental platform, clears up a lot of confusion. They aim to provide quick access to funds with clear terms, and they consider people who might not have perfect credit, which is pretty inclusive.

Before you commit, it's always a good idea to read all the terms and conditions very carefully. Understand the interest rates, the repayment schedule, and any other details. This way, you're fully informed and can make a decision that feels right for your situation. You can also learn more about managing your money by visiting helpful resources like the Consumer Financial Protection Bureau, which is a good idea, you know.

Ultimately, whether Lendly.com is the right fit for you depends on your specific financial circumstances and how comfortable you are with their offerings. They do seem to offer a convenient way to get money quickly for those who meet their requirements. For more general information about financial choices, you might want to learn more about online credit options on our site, and also check out this page on understanding loan terms.

Frequently Asked Questions About Lendly

People often have a few common questions when they're looking into services like Lendly. Here are some answers to things you might be wondering, you know, to help clear things up even more.

Is Lendly.com a direct lender?

Yes, Lendly.com operates as an online lender, meaning they provide the loans directly to you. They are not, for example, just a platform that connects you with other lenders. This means you deal directly with them throughout the loan process, which can be simpler for some people, actually.

What kind of loans does Lendly.com offer?

Lendly.com offers two main types of financial products. They provide lines of credit, which give you flexible access to funds up to a certain limit, from $300 to $1,500. They also offer online installment loans, which are for specific amounts like $1,000, $1,500, or $2,000, and are paid back over time with set payments. So, you have a couple of choices, you know, depending on what you need.

How fast can I get money from Lendly.com?

Lendly.com states that quick funding is available. You can receive the cash you need in as little as 24 hours after approval. This speed is a big benefit for people who are facing urgent financial situations and need access to funds very quickly, you know. It's a pretty fast turnaround for an online service.

Legit Tv

Lendli

Legit.ng - The long wait is over! It is time for...