Is Lendly Legit? What You Need To Know About This Online Lender

Many people find themselves looking for financial help, and the search for quick, reliable options often leads to online lenders. It's a very common thing, you know, to wonder about a company you find online, especially when it involves your money. A big question that comes up for many is, "Is Lendly legit?" That's a fair concern, and it's smart to ask before you move forward with anything.

Finding a financial service that feels right for you can be a bit of a process, and you want to feel good about your choice. People are looking for clarity, they want to know if a company is trustworthy or if there's something to worry about. So, this article is here to help you sort through what Lendly is all about, based on the details available.

We'll look at how Lendly works, what kind of services they offer, and what you might expect if you consider them for your financial needs. It’s important to get a clear picture, so you can decide if this particular online lender fits what you are looking for. We'll try to answer your questions and give you some things to think about, too it's almost like a guide.

Table of Contents

- What Exactly is Lendly?

- How Lendly Helps with Cash Needs

- The Application Process and Credit

- What You Get with Lendly

- Staying in Control

- Is Lendly a Trustworthy Option?

- Frequently Asked Questions About Lendly

What Exactly is Lendly?

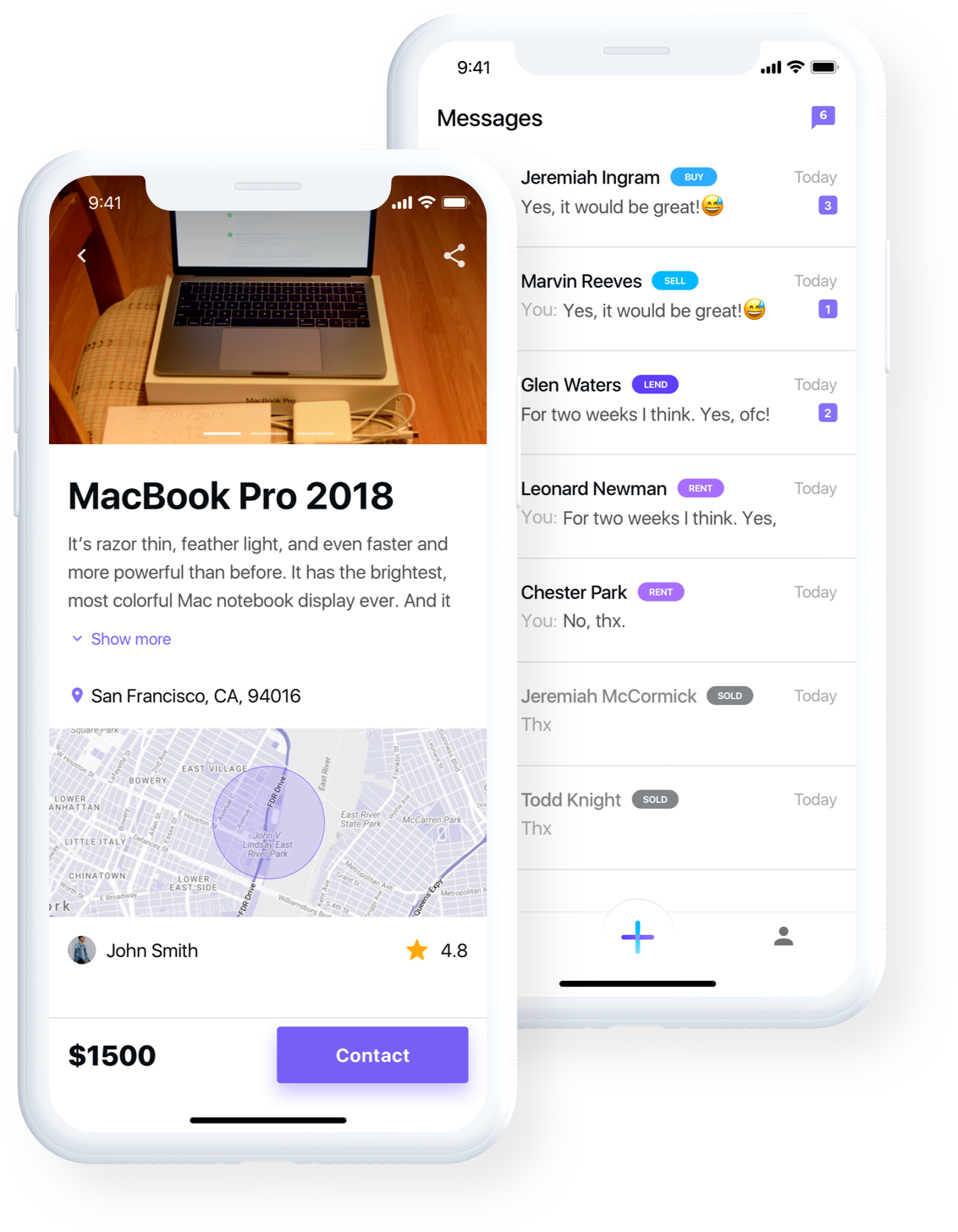

Lendly is an online lender, that much is clear from the information we have. They focus on offering smaller loans to people who might need a bit of financial assistance. They are set up as a place where you can get an online installment loan. It’s worth noting that there is also a platform called "lendli.org" which is for renting items and is not a financial service; this article focuses solely on "Lendly," the online lender that provides money.

The company states that they make it simple to keep things in order, which is a pretty good promise for anyone looking for financial services. They are an online presence, meaning you can access their services from wherever you are, which is quite convenient for many people. You know, sometimes you just need to handle things from home, and that's where an online lender can be helpful.

Lendly is specifically designed for people who have at least six months of job history. This detail suggests they are looking for a certain level of stability from their applicants. They also mention that having "stellar credit isn't required," which could be a big relief for folks who have had some financial bumps along the way. So, it seems they are trying to reach a wider group of people, not just those with perfect credit scores.

How Lendly Helps with Cash Needs

Lendly offers what they call a line of credit. This type of credit gives you some flexibility, which is often what people are looking for when they need cash. With a line of credit, you can access money as you need it, up to a certain limit. This is different from a lump-sum loan where you get all the money at once. It’s a way to have funds available for different situations, you know, when unexpected costs pop up.

The amounts available through Lendly's line of credit range from $300 to $1,500. This size of credit is typically for smaller, more immediate needs. For some people, that range is just what they need to cover a gap or handle an unexpected bill. They also mention that they offer installment loans up to $2,000, so it seems they have a couple of different options for different amounts of money, too it's almost like they're trying to cover a few bases.

One of the things Lendly highlights is their quick funding. They say you can get cash in as little as 24 hours. This speed is a big draw for many people who are in a hurry for funds. When you're facing an urgent expense, waiting days or weeks for money just isn't an option. So, getting fast cash is a key part of their service, which is pretty compelling for folks in a pinch.

The Application Process and Credit

When you apply for a loan with Lendly, there's something specific to keep in mind regarding your credit. They state that a credit inquiry will likely show up in your credit history. This is a common practice for lenders when you apply for credit, so it’s not really surprising. It’s just how these things work, you know, when a financial institution checks your background.

This credit inquiry, they say, may have a small impact on your overall credit score. It's important to understand that any time a lender looks at your credit, there's a chance it could cause a slight dip. However, they emphasize that it's a "small impact," which might ease some worries for people concerned about their credit. It’s just a little something to be aware of, but it sounds like it’s not meant to be a big deal.

As mentioned earlier, Lendly doesn't require "stellar credit." This means they might be more open to approving people who have credit scores that aren't perfect. This can be a big advantage for individuals who have struggled to get approved elsewhere. They do, however, require you to have at least six months of job history, which is their way of looking for some stability. So, while credit isn't the only factor, job history is pretty important to them.

What You Get with Lendly

Lendly offers online installment loans. An installment loan means you pay back the money you borrow over a set period, with regular payments. This structure can be helpful because it makes budgeting for repayments a bit more predictable. You know what to expect each time, which can make managing your finances a little easier. They focus on providing these types of loans, rather than, say, short-term payday loans.

They also make a point of saying there are "no hidden fees or hassle!" This is a pretty big claim and a very welcome one for anyone dealing with financial services. Hidden fees can be a real headache and make it hard to understand the true cost of borrowing money. So, the promise of transparency in their fee structure is a strong point in their favor, as a matter of fact.

The amounts available for these installment loans can go up to $2,000. So, whether you need $1,000, $1,500, or $2,000, they seem to have options within that range. This flexibility in amounts, combined with the promise of no hidden fees, could make them an appealing choice for people seeking a straightforward loan. It's just about finding the right amount for your specific needs, you know.

Staying in Control

Lendly states that they make it easy for you to "stay in control." This idea of control is pretty important when you're dealing with your money. It suggests that their processes and services are designed to be user-friendly and give you a sense of agency over your financial decisions. This could mean clear communication and simple terms, which is always good, you know, for anyone trying to keep track of their money.

Part of this control also comes with the flexibility of their line of credit. Having the option to access cash when you need it, rather than getting a large sum all at once, allows you to manage your funds more precisely. You only take out what you require, which can prevent you from borrowing more than you truly need. This kind of flexibility is quite helpful for managing unexpected expenses, you know, as they come up.

They also mention that subscribing to SMS notifications is optional and not needed to use any of their services. This is another way they seem to give you control over how you interact with them. You can choose to get messages or not, and you can opt out at any time by texting 'stop'. This level of choice is pretty good, as a matter of fact, allowing you to manage how they communicate with you.

Is Lendly a Trustworthy Option?

When you ask "is Lendly legit," you're really asking about trustworthiness and reliability. Based on the information provided, Lendly presents itself as a straightforward online lender. They outline their loan amounts, their quick funding process, and their policy on credit inquiries. They also clearly state that there are no hidden fees, which is a significant factor in building trust with customers. People often worry about surprises with financial products, so that transparency is a good sign.

The fact that they specify requirements like job history and acknowledge a small credit impact shows a certain level of directness. They are not promising something for nothing, which is often a red flag with less reputable services. They are also clear about how you can manage communications, like opting out of SMS. This kind of openness helps people feel more secure about who they are dealing with, you know, when it comes to their money.

Ultimately, deciding if Lendly is a good fit for you means weighing their stated services against your own financial situation and needs. They offer small loans with quick access to funds and a focus on transparency regarding fees and credit impact. If these aspects align with what you are looking for in an online lender, then they might be a choice to consider. It’s about finding a service that fits your situation, you know, and offers what you need.

It's always a good idea to read reviews and gather as much information as you can about any financial service before committing. You can learn more about consumer financial protections from official sources, which can help you understand your rights and what to look for in a lender. This extra step helps you make a choice that feels right for you, too it's almost like doing your homework.

Frequently Asked Questions About Lendly

How does applying for a Lendly loan affect my credit?

When you apply for a Lendly loan, a credit inquiry will likely appear in your credit history. This may have a small impact on your overall credit score. It's a standard part of the process for most loan applications, so it's something to expect, you know, when a lender checks your background.

What kind of loans does Lendly offer?

Lendly is an online lender that offers small loans, including a line of credit ranging from $300 to $1,500. They also provide online installment loans, which can go up to $2,000. These options are designed to give you flexibility and quick access to cash when you need it, which is pretty handy, you know, for unexpected costs.

How quickly can I get money from Lendly?

Lendly highlights quick funding, with cash available in as little as 24 hours after approval. This speed is a key part of their service, aimed at helping people who need fast access to funds for various needs. So, if you're in a hurry, that's a pretty good timeline, as a matter of fact.

You can learn more about financial options on our site, and you might also find helpful details on this page about online lending practices.

Legit Tv

Lendli

Legit.ng - The long wait is over! It is time for...